us germany tax treaty withholding rates

All persons withholding agents making US-source fixed determinable annual or periodical FDAP payments to foreign persons generally must report. Country Treaty with US.

Faq German Tax System Steuerkanzlei Pfleger

15 10 30 unless rates provided by DTTs.

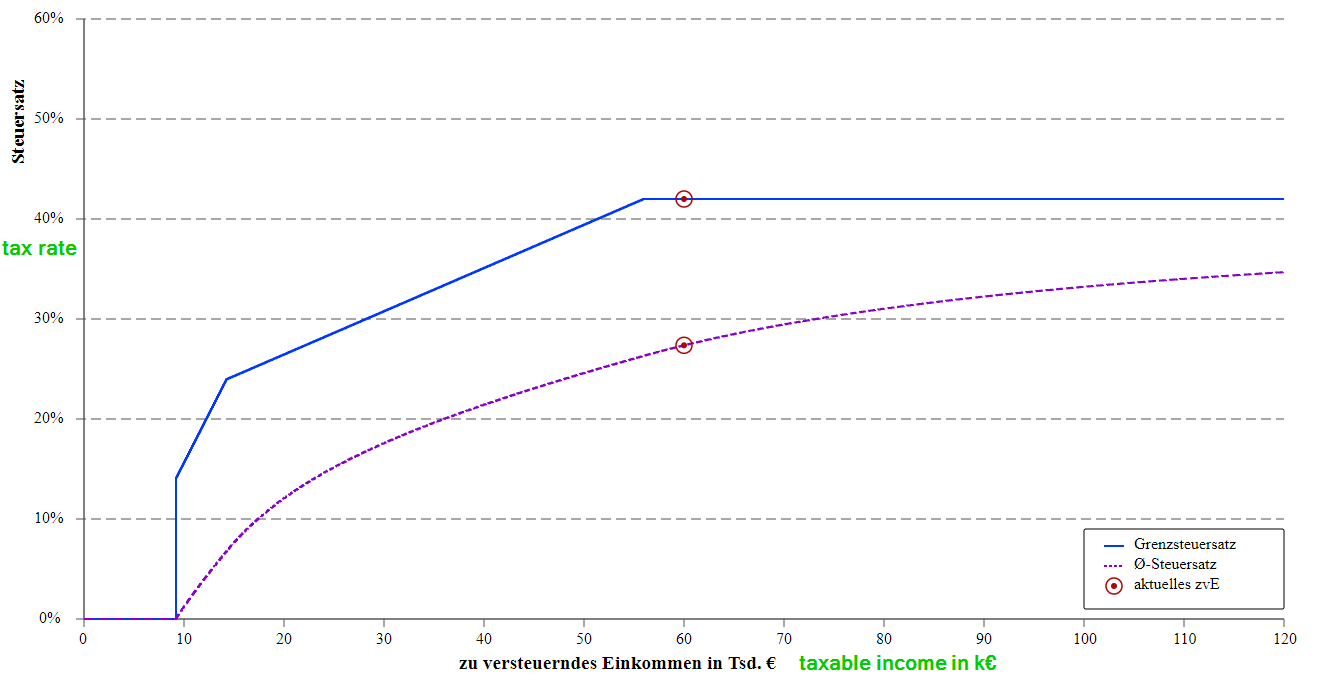

. Germanys default interest withholding tax rate is 0. German income tax rates range from 0 to 45. If you claim treaty benefits that override or modify any provision of the Internal Revenue Code and by claiming these benefits your tax is or might be reduced you must attach a fully completed Form 8833 Treaty-Based Return Position Disclosure Under Section 6114 or 7701 b to your tax return.

Non-resident corporations can apply to the Federal Central Tax Office for a 40 refund bringing the dividend withholding tax rate down to the CIT rate of 15 plus the solidarity surcharge resulting in an effective 15825 rate. A treaty may stipulate a higher rate. Some states honor the provisions of US.

The United States Germany Tax Treaty. Provisions of the existing convention permit German resident investors to make portfolio investments in the United States through United States Regulated Investment Companies RICs and receive an exemption on the income in the Federal Republic. Tax Guide for Aliens and Publication 515 Withholding of Tax on Nonresident Aliens and Foreign Entities.

However DTTs have not been concluded. Also see Publication 519 US. The United States Germany Tax Treaty covers double taxation with regards to income tax corporation tax and capital gains tax.

Germany tax rate for foreigners is also the same progressive rate starting at 14 and upto 45 for those with high earnings. Alongside income tax there is also a solidarity tax of a maximum of 55 of the income tax you owe. Algeria Last reviewed 02 March 2022 Resident.

In general most situations are based on residency status - is the person. For further information on tax treaties refer also to the Treasury Departments Tax Treaty Documents page. This table should not be relied on to determine whether a US.

On June 1 2006 the United States and Germany signed a protocol. The complete texts of the following tax treaty documents are available in Adobe PDF format. Angola Last reviewed 14 December 2021 Dividends and royalties are taxed at 10 and the tax is.

Detailed description of corporate withholding taxes in Germany Notes. Obligors General Treaty. Article 11 1 of the United States- Germany Income Tax Treaty generally grants to the State of residence the exclusive right to tax interest beneficially owned by its residents and arising in the other Contracting State.

Tax resident is entitled to the listed rate of tax from a foreign treaty country although generally the treaty rates of tax are the same. German income tax rates are relatively high compared to the US so for many people it will make sense to claim the Foreign Tax Credit. Withholding tax and capital gains tax.

Interest ccc Dividends Pensions and Annuities Income Code Number 1 6 7 15 Name Code Paid by US. Germany - Tax Treaty Documents. Benefits under the income tax treaties of the United States with the United Kingdom and the Netherlands and if the relevant protocol is ratified Denmark Finland and Sweden.

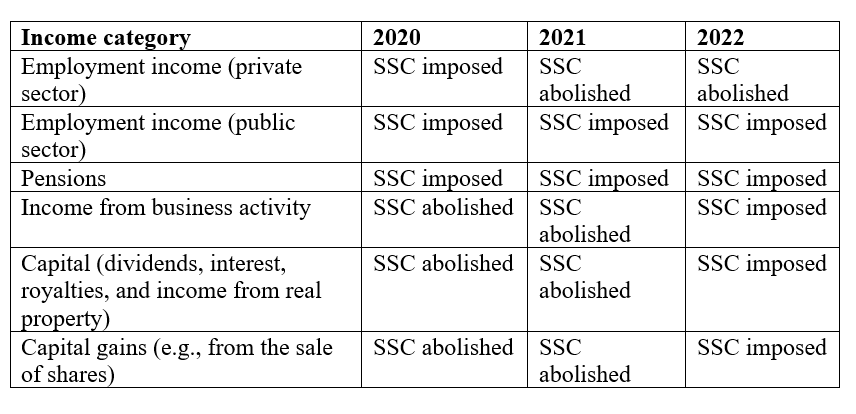

Germany has concluded DTTs applicable for income taxes with nearly 90 countries amongst them most of the industrialised countries. Many of the individual states of the United States tax the income of their residents. On 30 April 2022 the amending protocol to the Double Taxation Agreement DTA between Netherlands and.

The German federal government in January 2021 adopted a draft bill to modernize the provisions for relief from withholding tax and the certification of capital gains tax. Exemption on Your Tax Return. A treaty between Germany and the United States helps clarify situations concerning which country any taxes must be paid to.

Convention between the United States of America and the Federal Republic of Germany for the Avoidance of Double Taxation and the Prevention of Fiscal Evasion with respect to Taxes on income and Capital and to Certain Other Taxes together with a related Protocol signed at Bonn on August 29 1989. Technical Explanation of the Convention. German national income tax law has been modified and superseded by various tax treaties with foreign countries to ensure that income is not taxed by more than one country.

Dividends Article 10 Status quo Under the Treaty the withholding tax rate on dividends is equal to 5 percent of the gross amount of dividends. Tax Rates on Income Other Than Personal Service Income Under Chapter 3 Internal Revenue Code and Income Tax Treaties Rev. Last reviewed - 01 February 2022.

15 10 0 but VAT at 19 unless exempted. The Germany-US double taxation. Under US domestic tax laws a foreign person generally is subject to 30 US tax on the gross amount of certain US-source income.

US Germany Tax Treaty. This table lists the income tax and withholding rates on income other than for personal service income including rates for interest dividends royalties pensions and annuities and social security payments. Some forms of income are exempt from tax or qualify for reduced rates.

The reduced 5 withholding tax rate would not be available for RICs but the exemption from. If you have problems opening the pdf document or viewing pages download the latest version of Adobe Acrobat Reader. In fact under a 2006 amendment to the US-Germany income.

The purpose of the Germany-USA double taxation treaty. United States Yes 28 Uruguay No 30 US Virgin Islands No 30 Uzbekistan Yes 30. The United States withholding rate on such dividend to German investors will remain at 15 percent.

Corporate recipients of dividend and interest income interest on convertible and profit-sharing bonds can apply for refund of the tax withheld over the corporation tax rate of 15 plus solidarity surcharge regardless of any further relief available under a treaty. Germany Yes 15 Ghana No 30 Gibraltar No 30 Greece Yes 30 Greenland No 30 Grenada No 30. Corporate - Withholding taxes.

Germany is a member of the European Union EU the United Nations UN NATA the G G20 and OECD. The double taxation treaty or the income tax agreement between Germany and the United States of America entered into force in 1990 and it serves as an instrument for the abolition of double taxation on income earned by US and German residents who do business in both countries. Convention between the United States of America and the Federal Republic of Germany for the Avoidance of Double Taxation and the Prevention of Fiscal Evasion with respect to Taxes on income and Capital.

Article 11 of the United States- Germany Income Tax Treaty deals with the taxation interest. Double Tax Treaties DTTs According to the US withholding tax regulations a non-resident alien may claim Treaty relief if this person is entitled to Treaty benefits. Withholding Tax Rate Afghanistan No 30 Albania No 30 Algeria No 30 American Samoa No 30 Andorra No 30.

Status Of Russia S Initiative On Amending Its International Tax Treaties To Increase Withholding Tax Rate On Dividends And Interest To 15 Percent Deloitto China

Withholding Tax Rates To Non Residents Download Table

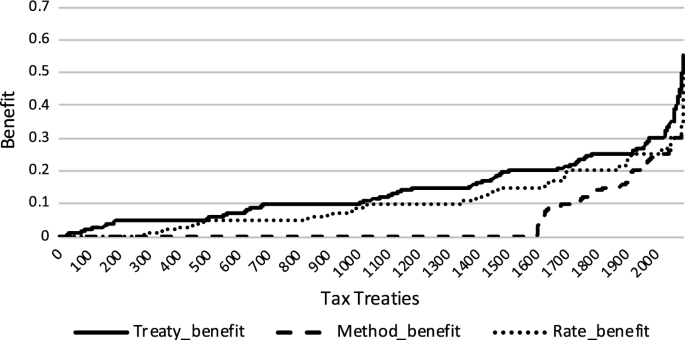

Analysis Of Operations And Effects Of The Method Of Elimination Of Double Taxation Taxbeech

Income Tax In Germany For Expat Employees Expatica

Pdf German Tax System Double Taxation Avoidance Conventions Structure And Developments

Fin 440 International Finance Ppt Download

Greece Enacts Corporate Tax Rate Reduction Other Support Measures Mne Tax

On The Relevance Of Double Tax Treaties Springerlink

Analysis Of Operations And Effects Of The Method Of Elimination Of Double Taxation Taxbeech

Withholding Tax Rates To Non Residents Download Table

Germany S Tax Treatment Of Cross Border Royalty Payments To Non Residents Grin

Tax Returns Tax Return Chart Powerpoint Word

Laos To Implement New Income Tax Rates Income Tax Lao Peoples Democratic Republic

Analysis Of Operations And Effects Of The Method Of Elimination Of Double Taxation Taxbeech